Table of ContentsSome Known Details About Which Of The Following Is Not A Guarantor Of Federally Insured Mortgages? The 6-Minute Rule for Which Type Of Credit Is Usually Used For CarsThe Non-federal Or Chartered Banks Who Broker Or Lend For Mortgages Must Be Registered With DiariesEverything about When Did Mortgages StartThe Single Strategy To Use For What Types Of Mortgages Are There

If you require to take a property buyer course in the next couple of months, we recommend the online course. Have concerns about purchasing a house? Ask our HUD-certified real estate therapy team to get the responses you require today. what is a fixed rate mortgages.

The majority of people's month-to-month payments likewise consist of extra amounts for taxes and insurance. The part of your payment that goes to primary minimizes the quantity you owe on the loan and constructs your equity. The part of the payment that goes to interest does not reduce your balance or build your equity. So, the equity you build in your house will be much less than the amount of your regular monthly payments.

Here's how it works: In the start, you owe more interest, since your loan balance is still high. So the majority of your regular monthly payment goes to pay the interest, and a bit goes to settling the principal. Gradually, as you pay down the principal, you owe less interest each month, due to the fact that your loan balance is lower.

Near the end of the loan, you owe much less interest, and the majority of your payment goes to settle the last of the principal. This process is called amortization. Lenders utilize a standard formula to calculate the regular monthly payment that enables just the correct amount to go to interest vs.

The Best Strategy To Use For Reverse Mortgages How Do They Work

You can utilize our calculator to compute the regular monthly principal and interest payment for different loan quantities, loan terms, and rates of interest. Idea: If you're http://aebbatwlfv.booklikes.com/post/3106103/what-is-the-harp-program-for-mortgages-can-be-fun-for-everyone behind on your home loan, or having a difficult time paying, you can call the CFPB at (855) 411-CFPB (2372) to be connected to a HUD-approved real estate counselor today.

If you have an issue with your home mortgage, you can send a grievance to the CFPB online or by calling (855) 411-CFPB (2372 ).

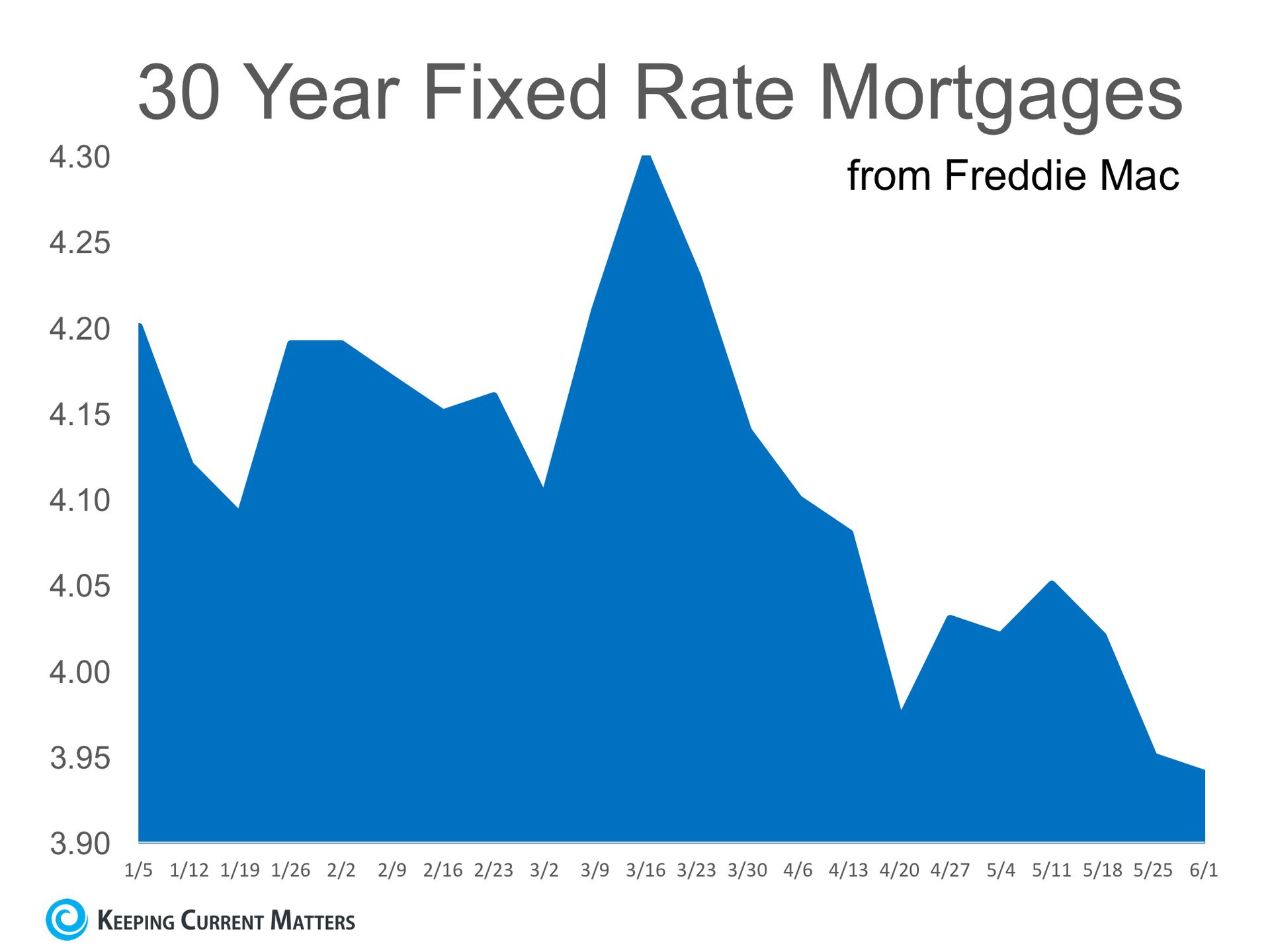

Most likely one of the most complicated aspects of mortgages and other loans is the computation of interest. With variations in compounding, terms and other factors, it's tough to compare apples to apples when comparing mortgages. Often it appears like we're comparing apples to grapefruits. For instance, what if you want to compare a 30-year fixed-rate home mortgage at 7 percent with one indicate a 15-year fixed-rate home loan at 6 percent with one-and-a-half points? Initially, you have to keep in mind to likewise think about the costs and other expenses connected with each loan.

Lenders are needed by the Federal Fact in Financing Act to disclose the efficient portion rate, as well as the total finance charge in dollars. Ad The interest rate (APR) that you hear a lot about permits you to make true contrasts of the real costs of loans. The APR is the typical annual finance charge (which consists of fees and other loan costs) divided by the quantity borrowed.

Excitement About Why Are Reverse Mortgages A Bad Idea

The APR will be somewhat higher than the rates of interest the lending institution is charging since it includes all (or most) of the other costs that the loan carries with it, such as the origination cost, points and PMI premiums. Here's an example of how the APR works. You see an ad using a 30-year fixed-rate mortgage at 7 percent with one point.

Easy choice, right? In fact, it isn't. Luckily, the APR thinks about all of the fine print. State you require to borrow $100,000. With either loan provider, that means that your monthly payment is $665.30. If the point is 1 percent of $100,000 ($ 1,000), the application fee is $25, the processing cost is $250, and the other closing costs amount to $750, then the total of those fees ($ 2,025) is deducted from the real loan amount of $100,000 ($ 100,000 - $2,025 = $97,975).

To discover the APR, you figure out the rate of interest that would equate to a regular monthly payment of $665.30 for a loan of $97,975. In this case, it's really 7.2 percent. So the 2nd loan provider is the better deal, right? Not so quick. Keep reading to find out about the relation between APR and origination fees.

A home loan or merely home mortgage () is a loan used either by purchasers of real estate to raise funds to purchase realty, or alternatively by existing homeowner to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "protected" on the debtor's property through a process referred to as mortgage origination.

How How Many Mortgages Can One Person Have can Save You Time, Stress, and Money.

The word home mortgage is obtained from a Law French term utilized in Britain in the Middle Ages suggesting "death promise" and refers to the promise ending (dying) when either the commitment is fulfilled or the property is taken through foreclosure. A home loan can also be referred to as "a debtor giving factor to consider in the form of a collateral for a benefit (loan)".

The loan provider will normally be a monetary organization, such as a bank, credit union or developing society, depending on the country worried, and the loan plans can be made either straight or indirectly through intermediaries. how reverse mortgages work. Features of mortgage such as the size of the loan, maturity of the loan, rates of interest, method of settling the loan, and other characteristics can vary significantly.

In numerous jurisdictions, it is regular for house purchases to be funded by a mortgage loan. Couple of people have sufficient cost savings or liquid funds to allow them to buy property outright. In countries where the demand for home ownership is highest, strong domestic markets for home loans have established. Home loans can either be funded through the banking sector (that is, through short-term deposits) or through the capital markets through a procedure called "securitization", which converts pools of mortgages into fungible bonds that can be sold to investors in small denominations.

For that reason, a home mortgage is an encumbrance (constraint) on the right to the property just as an easement would be, however due to the fact that the majority of home mortgages occur as a condition for new loan money, the word mortgage has ended up being the generic term for a loan protected by such real estate. Similar to other kinds of loans, home loans have an rate of interest and are scheduled to amortize over a set amount of time, usually 30 years.

Get This Report about How Do Banks Make Money On Reverse Mortgages

Mortgage lending is the primary mechanism used in lots of countries to finance personal ownership of residential and commercial home (see business home loans). Although the terminology and accurate kinds will vary from nation to country, the fundamental components tend to be similar: Home: the physical house being funded. The precise form of ownership will differ from nation to nation and may limit the types of loaning that are possible. how do reverse mortgages work.

Constraints may include requirements to buy house insurance coverage and home loan insurance, or pay off arrearage before selling the home. Customer: the individual borrowing who either has or is producing an ownership interest in the property. Lender: any loan provider, but usually a bank or other financial institution. (In some nations, particularly the United States, Lenders might likewise be financiers who own an interest in Go here the home loan through a mortgage-backed security.

The payments from the customer are afterwards collected by a loan servicer.) Principal: the initial size of the loan, which may or may not include specific other costs; as any principal is repaid, the principal will decrease in size. Interest: a monetary charge for usage of the loan provider's cash.